Deciding when and how to claim Social Security benefits is one of the most important decisions that retirees will ever make.

For most retirees, Social Security is a critical piece of the retirement income puzzle. In an era of disappearing pensions, it is one of the few sources of guaranteed income that lasts a lifetime, no matter how long you live.

While Social Security represents the single largest source of retirement income for the majority of older Americans, it was never designed to be the sole source of income. Social Security replaces about 40% of pre-retirement earnings for median-income workers and even less for high earners. That means you will need other sources of income, such as a pension, Individual Retirement Account (IRA), or workplace-based retirement savings plans such as a 401(k) or 403(b) to supplement your Social Security benefits and fund a comfortable retirement.

How do you qualify for Social Security? When you work and pay Social Security payroll taxes, you earn up to four credits per year toward future benefits. You must work at least 10 years to earn the minimum of 40 credits needed to qualify for Social Security retirement benefits. If you stop working before you have enough credits to qualify for benefits, the credits will remain on your Social Security record. If you return to work later, you can add more credits to qualify for future benefits.

Social Security cannot pay you any retirement benefits if you don’t have enough work credits, but if you are married or divorced, you may be able to collect benefits as a spouse or eligible ex-spouse. (See Strategies for Married Couples and Rules for Divorced Spouses)

How much will your Social Security benefits be? The dollar amount of your monthly Social Security benefit is based on your average lifetime earnings and your age at time of claim. The Social Security Administration (SSA) bases your benefits on your top 35 years of earnings. If you work fewer than 35 years, the calculation will include some zeroes and mean smaller future benefits.

Your actual earnings are adjusted or “indexed” to account for changes in average wages since the year the earnings were received. SSA calculates your average indexed monthly earnings during your top 35 earning years and applies a formula to those earnings to arrive at your basic benefit or “primary insurance amount” (PIA). This is how much you would receive at your full retirement age, which varies from 66 to 67, depending on your year of birth.

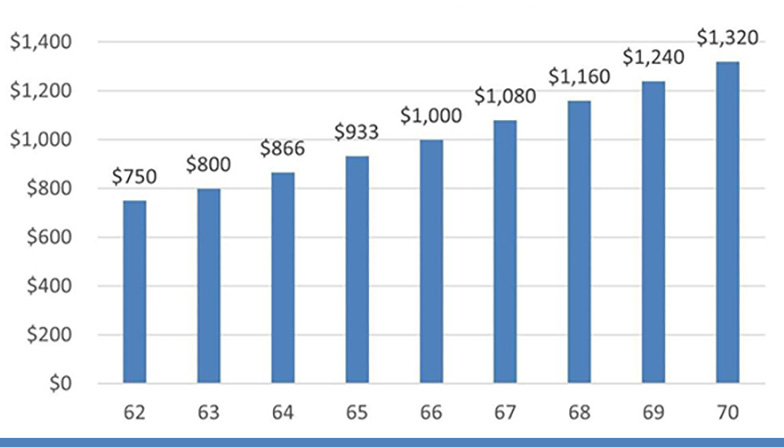

The age at which you claim your benefits determines the amount of your monthly payment. If you claim benefits before your full retirement age, your benefit will be reduced. If you are willing to delay claiming your benefits, up to age 70, they will be larger for the rest of your life. The table below illustrates the effect of claiming Social Security benefits early. Assumes a $1,000 per monthly primary insurance (PIA) amount at full retirement age.

Decrease in Benefits for Claiming Early

Assumes $1,000 PIA at Full Retirement Age (FRA)

| Birth Year | FRA | Benefit at 62 | % Reduction at 62 |

| 1943-1954 | 66 | $750 | 25.00% |

| 1955 | 66 and 2 months | $741 | 25.83% |

| 1956 | 66 and 4 months | $733 | 26.67% |

| 1957 | 66 and 6 months | $725 | 27.50% |

| 1958 | 66 and 8 months | $716 | 28.33% |

| 1959 | 66 and 10 months | $708 | 29.17% |

| 1960 or later | 67 | $700 | 30.00% |

On the other hand, if you are willing to postpone claiming benefits, you will be rewarded for your patience. For every month you wait to collect Social Security beyond your full retirement age you earn delayed retirement credits worth 0.66% per month for a total of 8% per year, up to age 70. (See graph below).

Monthly Benefit Based on Claiming Age

Assumes a benefit of $1,000 at full retirement age of 66

76% increase for claiming at 70 vs 62

For someone whose full retirement age (FRA) is 66, delaying Social Security benefits until 70 will result in a whopping 32% increase in benefits. That means if your FRA benefit is $2,000 per month at age 66 and you wait until 70 to collect, your benefits will grow by 8% per year for four years and be worth $2,640 per month at 70 ($2,000 x 1.32). If you were born in 1960 or later, your full retirement age is 67. That means you could earn up to 24% in delayed retirement credits for postponing benefits three years beyond your full retirement age to age 70 to claim the maximum retirement benefit.

The actual payout will be even larger as annual cost-of-living adjustments (COLA) for each of the intervening years between the time you first become eligible for benefits at 62 and the age you claim will be added to your monthly benefit amount. Waiting to collect the biggest benefit at age 70 means future COLAs will be applied to a bigger base, resulting in larger monthly payments for the rest of your life. Delayed retirement credits end when you turn 70, so it makes no sense to postpone claiming Social Security beyond that age.